#Splunk enterprise license upgrade#

As NPI helps enterprises keep up with and respond to these challenges, one thing is clear – there is leverage to be had for the well-informed and well-prepared buyer.Start Splunk Enterprise for the first timeīefore you begin using your new Splunk Enterprise upgrade or installation, take a few moments to make sure that the software and your data are secure.Īs part of the initial startup process, Splunk Enterprise prompts you to create credentials for the administrator user. The SIEM market is at an inflection point, which creates new opportunities and risks for enterprise customers. These services are often an added path to savings in addition to securing rate reductions from vendors. With data sizes continuing to grow (sometimes exponentially), more third-parties are beginning to offer tools specifically aimed at reducing total capacity needs for Splunk, New Relic and others in the field. We’ve seen some clients reduce GB/day capacity needs by 15 to 30 percent. Use of Tools to Reduce Capacity Needs for Splunk, New Relic and Others

#Splunk enterprise license license#

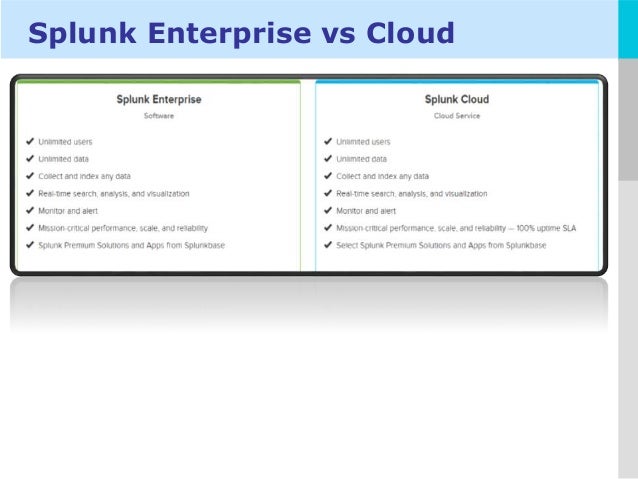

That includes ensuring pricing is at or below best-in-class targets, and performing license optimization to establish a baseline purchase that accurately aligns with usage requirements. NPI finds that converting over from any on-premise deals to Splunk or New Relic’s cloud solutions is an important sourcing event that sets pricing precedents far into the future, so it’s worth extra preparation. Splunk is more eager than ever to push large names to the cloud, and this can make sense for customers given how much hardware is required to run an ever-expanding on-premise footprint. NPI knows Splunk recently invested in expanding its own cloud solution capabilities to be able to handle larger customer data pools, but its solution is still mostly limited to the 50TB to 100TB per day range. Like most IT categories, cloud solutions remain a hot topic in this space, but scalability remains an issue to an extent. Positioning credible competitive threats with established players like Splunk and New Relic is becoming increasingly important, although we recognize this may not always be feasible given the high switching costs involved. Humio’s standard of only offering unlimited capacity deals is a good example. These newer market entrants and their customer engagement tactics are causing a stir in the market. Meanwhile, names like Humio (now acquired) and Devo that rarely came across our analysts’ desks in 2020 have become noticeably more frequent.

Emergence of New Competitorsīoth Splunk and New Relic have been dominant players in the SIEM category for years, but competitive dynamics are starting to reshape the market. Competition from vendors like LogRhythm, Datadog, and Dynatrace remains strong. When it comes to Splunk enterprise pricing, NPI recommends clients take a hard stance at staying on per GB metrics for the time being as vCPU/SVC metrics appear to be increasing client fee averages noticeably compared to traditional licensing. New Relic appears to be trying similar moves, but NPI hasn’t seen as much of a trend established outside the norm as compared to Splunk. These new pricing metrics are likely to give more of an advantage to the vendor in the long run when compared to per-GB. Many of the major players in this space like Splunk and New Relic had started offering new licensing alternatives to traditional per-GB capacity pricing in 2020. As NPI analyzes deals for our clients, we are seeing that Splunk has started making a more concentrated shift away from per GB price models.įor example, Splunk’s newer vCPU (on-premise) and Splunk Virtual Core or SVC (cloud) have seemingly become the vendor’s default pricing standard. Hard Shifts in Splunk Enterprise Pricing Models Inspire Similar Behavior from Competition The market is likely in for even more changes and volatility in the short term. This is especially evident with CrowdStrike’s $390M+ acquisition of Humio, a vendor that only recently entered the enterprise scene. We are starting to see competitors catch up to the leading market titans – a point I dig into further below – and the resultant shifts in vendor behavior are worth taking notice of. It’s important to point out just how white-hot the SIEM market is right now.

NPI is noticing certain behaviors among industry leaders in the market that rise above the noise. The confluence of these factors (and others) have prompted a shift in the SIEM (security information and event management) landscape – ranging from changes to Splunk enterprise pricing to the emergence of new players and beyond.

At the same time, many enterprises are experiencing spikes in IT security-related incidents. Last year, we saw many vendors experimenting with newer pricing models to meet shifting customer demands.

0 kommentar(er)

0 kommentar(er)